Cash Conversion Ratio Investopedia . the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and sales process of. what is the “cash conversion ratio”? The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. the cash conversion ratio (ccr) provides insights into the operational efficiency of a company, or more. the cash conversion ratio (ccr) measures a company's ability to convert profits into cash flow and assesses how well sales and earnings.

from www.slideteam.net

the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and sales process of. the cash conversion ratio (ccr) measures a company's ability to convert profits into cash flow and assesses how well sales and earnings. the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. what is the “cash conversion ratio”? The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion ratio (ccr) provides insights into the operational efficiency of a company, or more.

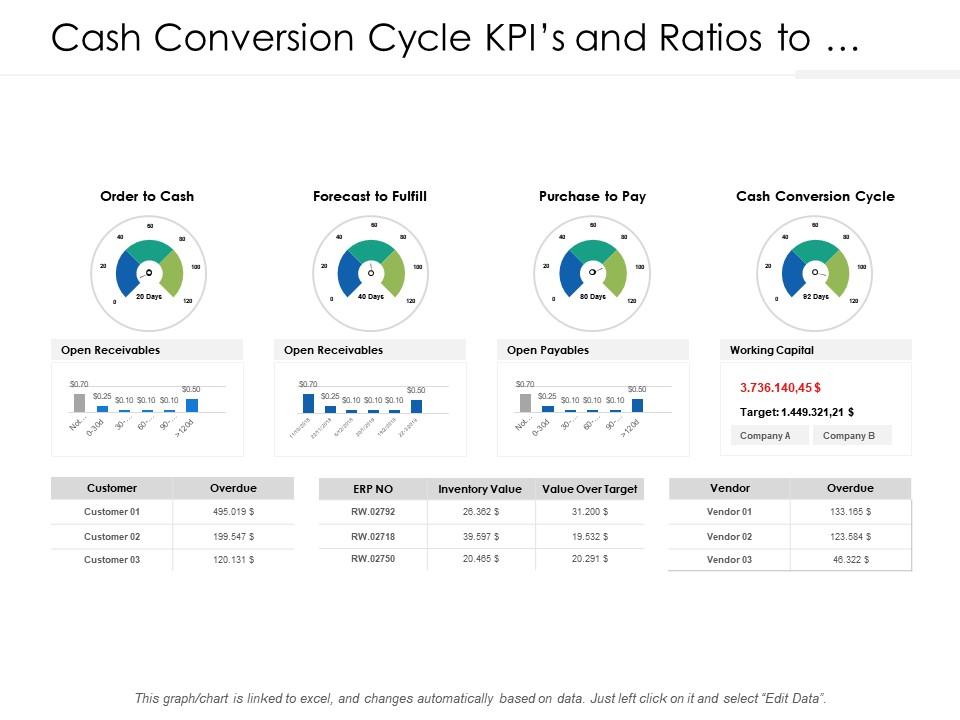

Cash Conversion Cycle Kpis And Ratios To Monitor The Work Capital

Cash Conversion Ratio Investopedia what is the “cash conversion ratio”? the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. the cash conversion ratio (ccr) measures a company's ability to convert profits into cash flow and assesses how well sales and earnings. what is the “cash conversion ratio”? the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and sales process of. the cash conversion ratio (ccr) provides insights into the operational efficiency of a company, or more.

From www.youtube.com

Activity Ratios Including Cash Conversion cycle YouTube Cash Conversion Ratio Investopedia what is the “cash conversion ratio”? the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. . Cash Conversion Ratio Investopedia.

From www.slideteam.net

Cash Conversion Cycle Kpis And Ratios To Monitor The Work Capital Cash Conversion Ratio Investopedia the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and sales process of. the cash conversion cycle (ccc) is a formula in management accounting that measures. Cash Conversion Ratio Investopedia.

From www.youtube.com

Liquidity and Cash Conversion Cycle I Explanation with example YouTube Cash Conversion Ratio Investopedia the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. the cash conversion ratio (ccr) provides insights into the operational efficiency of a company, or more. the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and. Cash Conversion Ratio Investopedia.

From www.emerald.com

Cash conversion cycle and financial performance evidence from Cash Conversion Ratio Investopedia the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. the cash conversion ratio (ccr) provides insights into the operational efficiency of a company, or more. what is the “cash conversion ratio”? the cash conversion ratio (ccr) measures a company's ability to convert profits into cash flow and assesses how well. Cash Conversion Ratio Investopedia.

From online-accounting.net

Current Ratio Definition Online Accounting Cash Conversion Ratio Investopedia the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. what is the “cash conversion ratio”? The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. the cash conversion cycle. Cash Conversion Ratio Investopedia.

From www.slideteam.net

Financial Performance KPI Dashboard With Working Capital And Cash Cash Conversion Ratio Investopedia what is the “cash conversion ratio”? the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. The cash conversion ratio (ccr) compares a company’s operating cash. . Cash Conversion Ratio Investopedia.

From www.investopedia.com

Conversion Ratio Definition, How It's Calculated, and Examples Cash Conversion Ratio Investopedia what is the “cash conversion ratio”? the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. the cash conversion ratio. Cash Conversion Ratio Investopedia.

From www.educba.com

Cash Ratio Formula Definition and Ananlysis with Examples Cash Conversion Ratio Investopedia the cash conversion ratio (ccr) measures a company's ability to convert profits into cash flow and assesses how well sales and earnings. the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. the cash conversion ratio (ccr) provides insights into the operational. Cash Conversion Ratio Investopedia.

From www.centime.com

Demystifying the Cash Conversion Cycle A Comprehensive Guide Centime Cash Conversion Ratio Investopedia the cash conversion ratio (ccr) provides insights into the operational efficiency of a company, or more. the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. the cash conversion cycle (ccc) measures the number of days a company's cash is tied up. Cash Conversion Ratio Investopedia.

From www.fe.training

Cash Conversion Ratio Financial Edge Cash Conversion Ratio Investopedia the cash conversion ratio (ccr) provides insights into the operational efficiency of a company, or more. the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion cycle (ccc) is the amount of time in days that a company takes. Cash Conversion Ratio Investopedia.

From accountingplay.com

Cash Conversion Cycle Accounting Play Cash Conversion Ratio Investopedia the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. the cash conversion cycle (ccc) is the amount of time in days that a company takes to. Cash Conversion Ratio Investopedia.

From www.vrogue.co

Cash Conversion Cycle Formula Calculator vrogue.co Cash Conversion Ratio Investopedia what is the “cash conversion ratio”? the cash conversion ratio (ccr) measures a company's ability to convert profits into cash flow and assesses how well sales and earnings. the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. the cash conversion ratio (ccr) provides insights. Cash Conversion Ratio Investopedia.

From www.vecteezy.com

Cash Conversion Cycle or CCC is a metric that expresses the time that Cash Conversion Ratio Investopedia the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and sales process of. the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. The cash conversion ratio (ccr) compares a company’s operating cash. what is the. Cash Conversion Ratio Investopedia.

From www.scribd.com

Cash Conversion Cycle What It Is and Why It's Important PDF Cash Conversion Ratio Investopedia the cash conversion cycle (ccc) is a formula in management accounting that measures how efficiently. the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion cycle (ccc) measures the number of days a. Cash Conversion Ratio Investopedia.

From www.myos.com

Cash Conversion Cycle Explained Cash Conversion Ratio Investopedia the cash conversion ratio (ccr) measures a company's ability to convert profits into cash flow and assesses how well sales and earnings. The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and sales process of. the cash. Cash Conversion Ratio Investopedia.

From miracletsc.blogspot.com

operating cash flow ratio calculator Good Here Diary Fonction Cash Conversion Ratio Investopedia the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. what is the “cash conversion ratio”? the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and sales process of. The cash conversion. Cash Conversion Ratio Investopedia.

From ezylearn.com.au

Here’s What You Need to Know About the Cash Conversion Cycle EzyLearn Cash Conversion Ratio Investopedia The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion ratio (ccr) measures a company's ability to convert profits into cash flow and assesses how well sales and earnings. the cash conversion cycle (ccc) measures the number of days a company's cash is tied up in the production and sales process of. the cash. Cash Conversion Ratio Investopedia.

From www.youtube.com

Cash Conversion Cycle Explained YouTube Cash Conversion Ratio Investopedia The cash conversion ratio (ccr) compares a company’s operating cash. the cash conversion ratio (ccr), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash. the cash conversion cycle (ccc) is the amount of time in days that a company takes to convert money spent on. what. Cash Conversion Ratio Investopedia.